Of the 10,000 international undergraduate and graduate students at McGill, some 7,000 are insured by a mandatory health insurance plan. This plan, privately contracted out to Medavie Blue Cross by McGill, has a premium of $906 per year for single person coverage. The Régie de l’Assurance Maladie du Québec (RAMQ), which provides medical insurance for Quebec residents, states that students from countries other than those with which Quebec has concluded a social security agreement providing for student coverage are ineligible for coverage. This makes it impossible for most international students to be covered by RAMQ.

Coverage through Blue Cross

According to the 2015-2016 Blue Cross documentation, charges arising from self-destruction or self-inflicted injuries, while “sane or insane,” are not covered for international students. Director of International Student Services, Pauline L’Ecuyer explained that this policy is consistent throughout many insurance companies.

“This is a clause that is quite standard in the industry,” L’Ecuyer said. “[For example], somebody who attempts suicide will not be paid life insurance.”

Director of McGill Student Health and Family Physician Pierre-Paul Tellier noted, however, that this clause does not match RAMQ coverage.

“Any of the [provincial] medical care plans will cover those things,” he said. “They cover medical problems, period.”

Blue Cross documentation additionally outlines that charges relating to a pre-existing medical condition in excess of $10,000 are not covered. International Student Advisor and Health Insurance Administrator Anastasia Koutouzov noted, however, this is a non-issue for such students.

“[Students] with pre-existing conditions understand the limit of the $10,000, and already have an alternative health insurance plan, so they don’t mind the clause,” Koutouzov said.

L’Ecuyer further explained that students with pre-existing conditions are not able to buy supplemental insurance in Canada, a practice which is supposed to serve the best interest of the insurance agency.

“If you put yourself in the shoes of the insurer, you are not going to sell a contract to somebody when it is known that they’re going to claim $10,000,” she said.

Tellier, who treats both Canadian and international students at the McGill Clinic, continued to outline the benefits of the Blue Cross plan for international students.

“One of the nice things about Blue Cross [is that] it’s such a broad insurance plan that it made some services available to [international students] that were not available to Canadian or Quebec students,” he said.

For example, physiotherapy, which is covered under the Blue Cross plan up for to $750 per year, was not previously covered for Canadian and Quebec students, who can instead purchase supplemental insurance from their student unions to cover such care.

Uncertainties about the reasoning behind some Blue Cross coverage policies and the policies of supplementary plans offered by the Students’ Society of McGill University (SSMU) and the Post-Graduate Students’ Society (PGSS) exist among administration. Through SSMU, international students have the option of purchasing a supplementary dental insurance plan. However, a SSMU supplementary vision care plan is only available to Canadians. L’Ecuyer acknowledges that the reasoning behind this is unclear.

“I don’t know,” L’Ecuyer said. “We tried to copy as much as possible [from] the RAMQ plan, but I don’t think we’ve ever been asked to look into this.”

The Blue Cross mandatory insurance plan for international students was re-evaluated and approved last year by the Advisory Committee on International Students (ACIS), a Canada-wide organizarion, following extensive lobbying by the PGSS. L’Ecuyer, explained the rationale behind having a mandatory plan.

“First of all, it was voted as a Senate regulation in 1967 that all McGill students and their dependents must subscribe to a plan [administered by] the university,”L’Ecuyer said. “[Secondly], about 20 years ago, it became immigration policy in Quebec.”

Limitations to family and dependent coverage

The Senate policy instituted by McGill in 1967 does not allow international students or their dependents—a spouse or a child—to choose their own insurance policies.

The premium for students with dependents is $2,781, and for a family with more than one dependent the sum comes up to $5,289. However, according to Tellier, the McGill Clinic does not offer services for dependents.

“We used to,” he explained. “But we were finally told by [the] administration [a few years ago] that we needed to cut that service.”

Tellier explained that funding cuts within the university have led to staff shortages at the McGill Clinic.

“Our service […] is limited,” Tellier said. “The administration decided they weren’t going to fund [nurse practitioner] positions […] which would have increased availability.”

For students with dependent or family plans, the up-front cost of private clinics can become prohibitive. Koutouzov noted that private clinics are an expensive alternative for dependents who cannot seek care at the McGill Clinic.

“Downtown, [costs] range up to $150 for an adult and […] $220 for pediatric appointments,” she explained.

The Blue Cross plan in perspective

In comparison to McGill, other Canadian universities offer vastly different options to their international students. At the University of British Columbia, for example, all students, whether international or not, are covered under the same policies. International students pay to register with the British Columbia provincial Medical Services Plan (MSP), and are required to register with an extended policy that provides prescription, vision, dental, and travel coverage. Such a policy is offered through the student unions; however, if students are already enrolled in an extended policy, they can request an exemption.

With the exception of McGill, Concordia University, and Bishop’s University, all universities in Quebec have adopted a consortium plan for international student health care through Desjardins. L’Ecuyer explained McGill is not partaking in the Quebec consortium plan because of rigid standards and a higher cost.

“Their premium is higher than ours,” L’Ecuyer said. “They have policies we don’t necessarily want to abide by. It does not offer any coverage to students with dependents and families, and our Senate regulations [do not allow] that.”

The limitations of the Blue Cross plan, according to Tellier, are countered by efforts on the part of the McGill Clinic to help international students struggling with financial limitations.

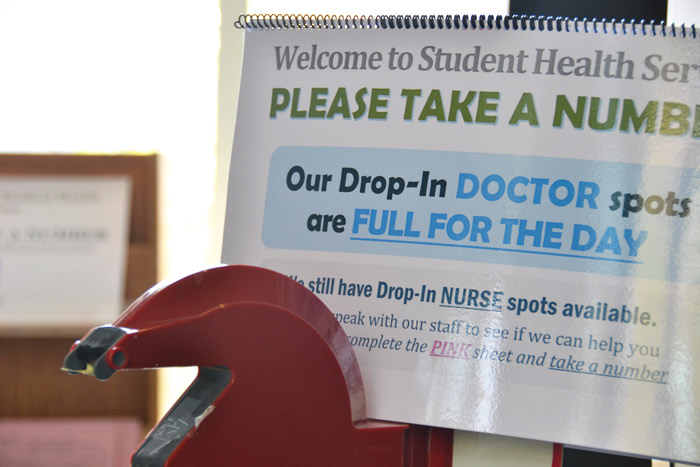

“Students who come into [the clinic] are not sent away,” Tellier said. “They can see a triage nurse, who advises them [on what they should do].”

Furthermore, L’Ecuyer explained that students who are in need can seek financial assistance from McGill.

“When students find themselves in a difficult situation, they can qualify for aid [to pay for the premium,” L’Ecuyer said. “I know they could go apply for assistance if [health care fees] didn’t fit in their budget.”

Student experience with the policy

While the Blue Cross plan and plans similar to it are common for international students in Quebec and Canada, many students have experienced complications and inconsistencies when dealing with their coverage. Céline Garandeau, a U2 Biology student from the United States, explained that during one visit to the Montreal General Hospital, she was unable to complete a procedure due to insurance complications and was charged $50.

“I went to Montreal General Hospital [for a procedure and…] the woman at the desk said that if I wanted the visit [to be] covered by Blue Cross, I would need to go to [McGill] and ask,” Garandeau said. “At Service Point, I was directed to call a number [but] things were hectic at the time and I didn’t call them or have [the procedure.…] I’m reluctant to deal with the system [….] I was expecting a simpler experience, where the hospital would contact Blue Cross.”

In addition to difficulty submitting claims, other students cite inconsistencies in the advice they are given about their coverage as a drawback of the plan’s administration. Jake Zhu, a Canadian U1 Software Engineering student, was informed that he was required to pay for the Blue Cross plan because he didn’t live in Canada immediately prior to his matriculation at McGill.

“I had every right to get [RAMQ] health care coverage,” Zhu said. “At the beginning of [my first] year, McGill told me […] that even though I am a Canadian citizen, I did not qualify because I was just a student. [But] when I went to the RAMQ office in January, they told me that I qualified.”

McGill’s documentation also explains that clinics are permitted to charge different rates for out-of-province and international patients; the portion of these fees that exceeds the RAMQ rate is the liability of the student. According to Koutouzov, if international students seek care at a clinic outside of McGill as an alternative, they are billed upfront for their visit.

“Because it’s not a regulated industry, [off-campus clinics] don’t have patient accounts like a hospital or the McGill Clinic,” Koutouzov said.

According to McGill and Blue Cross’s documentation, students are required to pay private clinic fees out of pocket and submit claims to Blue Cross after which can take two-three weeks to be repaid.

This is a nice article and a good example of detail-oriented investigative journalism.

One solution to this problem is, of course, to bring international students under Quebec Medicare (RAMQ) coverage, which is done in most provinces in Canada. The PGSS, for example, has a position in favor of this option.