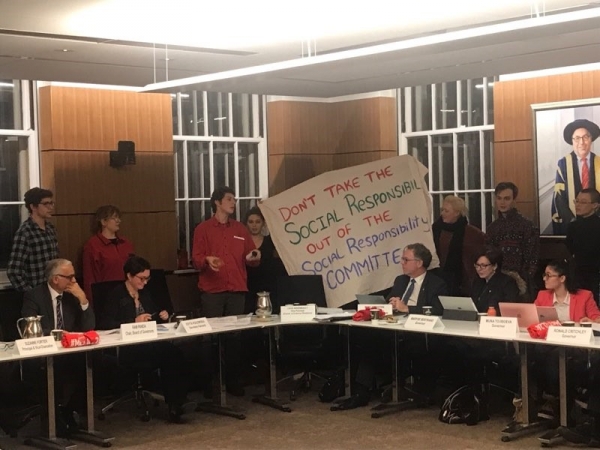

At the Dec. 12 McGill University Board of Governors (BoG) meeting, members of Divest McGill protested against a recent revision to the Committee to Advise on Matters of Social Responsibility’s (CAMSR) mandate. The policy change would prohibit the University from using the Endowment Fund to further specific social or political causes. CAMSR’s original purpose is to help fulfill the ethical and social responsibility clause of McGill’s Investment Policy for its endowment. Divest McGill’s aim is for McGill to divest those funds from fossil fuels. However, as the revision reflects, the purpose of the Endowment Fund as a whole is not to advance a particular social goal. While Divest McGill’s goal of fighting climate change by using the endowment fund might achieve symbolic benefit, this is outweighed by the financial costs and trade-offs.

The actual function of the Endowment Fund is to maintain the solvency of the various donations given to the University. According to the Investment Policy, a vast majority of these funds are already “externally restricted,” meaning that their use is earmarked for scholarships or other purposes; McGill merely invests the funds on behalf of the donor and then oversees the proper use of the funds. Seeing as it’s not truly McGill’s money, and that most of the money has already been assigned a purpose, it would be irresponsible for McGill to do anything with the funds other than ensure their continued solvency and growth.

That appears to be what the University is doing. McGill’s Investment Policy delineates asset classes in which the University can invest, and specifies an asset mix—the portions of the fund that can be invested in each asset. The asset mix shows a clear preference for diversification and safe investments. Assuming that the University invests optimally, it is achieving the highest possible return given its liquidity and risk preferences.

Changing McGill’s Endowment Fund asset composition to divest from fossil fuel companies would be costly. Divesting would mean lower returns at greater risk, which could jeopardize various forms of scholarship and library funding. Divest McGill’s demands to liquidate all investments in fossil fuel firms don’t justify the costs of such a move, as they provide little to no concrete benefit.

Liquidating the University’s holdings in an oil firm does no tangible harm to the firm, since McGill’s Endowment is certainly not large enough to prompt a significant drop in the share price or cause market panic. By buying already-issued equities, McGill is not providing the fossil fuel companies, or any company, with new or significant funding. The only way McGill could directly benefit a fossil fuel company and meaningfully contribute to climate change would be to buy a bond or commercial paper directly from the issuing oil company, a much closer business relationship than simply holding shares. Whether or not McGill presently does this is unclear. Nonetheless, the tangible harm that would be inflicted on oil companies by the University selling their shares is minimal, beyond a symbolic stance against climate change. Divesting from fossil fuel companies also ignores that firms like ExxonMobil are industry leaders in clean energy innovation.

Meanwhile, taking this symbolic stance against fossil fuels would mean less money for scholarships, libraries, and other on-campus resources and initiatives that the endowment reserves funds for.

If Divest McGill is serious about fighting climate change, there are practical steps it can encourage the University to take without compromising the financial health of the Endowment Fund. For example, Divest could construct an environmentally-conscious investment portfolio that meets the asset mix requirements and liquidity preferences of the fund with the same projected return, and propose it to the Investment Office. Alternatively, Divest McGill could raise money to create a fund specifically for the advancement of environmental research at McGill.

There are trade-offs to pursuing a specific social mission. Certainly, helping low-income students pay for university and rewarding hard work through merit scholarships are worthy goals as well, with clear benefits. In contrast, Divest’s demand likely comes with significant costs that a symbolic stance cannot fix.