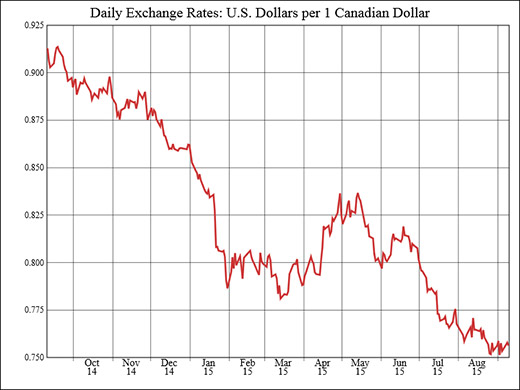

On Jan. 20, the Canadian dollar (CAD) fell to a new record low: It was the weakest the CAD had been since April 2003. On that day, every Canadian dollar was worth only 68.5 American cents, part of a larger and ongoing decline experienced by the loonie. Since then it has bounced back to equal about 72 American cents.

The origins of this steady downfall can be traced back to 2011, when the Canadian dollar was stronger than its American counterpart. In his commentary in The Globe and Mail, Chris Ragan, an associate professor of economics at McGill, outlined the two main factors involved: The decrease in global commodity prices and the difference between Canadian and US interest rates set by central banks.

Canada is a country blessed with abundant natural resources, ranging from oil and uranium to timber, fresh water, wild life, minerals, and arable land. These products, although a small fraction of the Canadian economy, represent a large portion of its exports, and this is what affects the exchange rate. Canada is one of the few developed countries along with Russia and Australia that is a net exporter of energy and natural commodities. Recent turmoil on the global economic and political scene, from slow economic growth in China to continued unnecessary overproduction of oil, has led to a decline in the price of natural commodities, the main one being oil.

When the world’s economic growth or an increase in a country’s capacity to produce goods and services slows down, the demand for natural resources goes down, dragging with it their prices. At the peak strength of the Canadian dollar, oil was selling at over a $100 USD a barrel. Now it is hovering at around $30 USD. The low price of oil causes the Canadian dollar to depreciate: Since less money is being earned per barrel sold, less money is being put back into the Canadian economy for the same amount of oil or other natural resources that are being exported.

“[As long as Canada remains] a large net exporter of resource-based products, lower commodity prices are bad for the overall Canadian economy,” Ragan explained. “But by the same logic, lower commodity prices strengthen the US dollar because the United States is a net importer of energy.”

The difference between the interest rate set by the US Federal Reserve and the Bank of Canada is the second major factor contributing to the depreciation of the Canadian dollar. This rate is known as an ‘overnight rate,’ and is defined by the Bank of Canada as ‘the interest rate at which major financial institutions borrow and lend one-day funds among themselves,’ depending on its available funds at the end of each business day. Changes in this rate influence other interest rates such as those of bank loans and mortgages. This interest rate is the essence of monetary policy and the central bank is setting these interest rates as part of its overall policy in targeting inflation.

Variations in these rates reflect the strength of an economy. Higher rates correspond with a well-performing economy and lower rates correspond with a struggling economy. In recent years the US economy has outperformed the Canadian economy, leading to a higher interest rate set by its central bank. Financial capital has consequently flown out of Canada in the hopes of reaping higher returns in the US, resulting in the depreciation of the Canadian dollar.

Though it may seem odd that the fiscal strength of one other country has such a major effect on the value of Canadian currency, ties between the US and Canada run very deep. The US is on the other side of a $700 billion trade pipeline with Canada, making it Canada’s biggest trade partner. According to CBC, in 2009, 73 per cent of Canada’s exports went to the US, and 63 per cent of Canada’s imports were from the US. With its sheer size and important geographic location, the US economy will continue to have a major impact on the strength of the Canadian economy and currency.

“It’s rich, it’s big, and it’s right beside us,” Ragan said.

A weak dollar is bad for Canadians importing or spending money on foreign goods and services. For example, a Canadian consumer who wants to purchase a product that costs $100 USD now will have to pay over a $140 CAD. On the other hand, an American consumer will pay less for the same Canadian goods as he or she did when the two currencies were equal. Thus a weak Canadian dollar, as it turns out, helps Canadian exporters because in the eyes of foreign buyers, the prices of Canadian goods have fallen.

It’s hard to predict how the value of the Canadian dollar will change. A good place to start, however, would be understanding the global prices of natural commodities like oil. As the prices of oil buoy, so does the loonie’s value.

So is Justin going to fix it?